Krishen Iyer and MAIS Consulting Come on Board to the Nashvox Team

May 19, 2021

<b>Krishen Iyer and MAIS Consulting come on board to help grow the largest growing recording studio and record label in Nashville, Tennessee</b> <br><br> <div> <a href="https://cdn.newswire.com/files/x/54/68/5c1d0a10ea06ee1083d1c884871b.jpg" target="_blank"> <img src="https://cdn.newswire.com/files/x/b2/0d/08eee597d6d12d4732bcf4f28d93.jpg" alt="Even Bad Vocals Welcome"> <br> <small><b>Even Bad Vocals Welcome</b></small> </a> <br> <small>Have Fun</small> <br><br> </div> SAN DIEGO - May 19, 2021 - (<a href="https://www.newswire.com/">Newswire.com</a>) <br> <p>Nashvox experiential recording studio expanded its leadership team on April 2, 2021, to include <u><a href="https://c212.net/c/link/?t=0&l=en&o=3156349-1&h=1968598458&u=https%3A%2F%2Fkrisheniyer.com%2F&a=Krishen+Sauble+Iyer&utm_source=VNN">Krishen Iyer</a></u> as minority owner and advisor. Iyer brings years of experience as a serial entrepreneur and business consultant to Nashvox. He and the existing Nashvox team will steer the studio through COVID precautions and plans for future growth.</p> <p>The Nashville establishment was founded by Teresa Smith and specifically caters to groups and parties, allowing more people to experience the thrill of recording music that has historically only been available to professionals. The recording location on 4th Avenue offers a music catalog of more than 19,000 songs from top artists like Luke Bryan and Lenny Kravitz and allows visitors to record original music. Each session is accompanied by a qualified sound engineer to guide the process.</p> <p><u><a href="https://c212.net/c/link/?t=0&l=en&o=3156349-1&h=1112041745&u=https%3A%2F%2Fwww.linkedin.com%2Fin%2Fkrishen-iyer-38223713b%2F&a=Iyer&utm_source=VNN">Iyer</a></u> feels confident in the studio's vision of making recording more accessible to the masses: "Whether you're part of a bridal party or a kid's birthday party, you're welcome. We want everyone of all ages to feel what it's like to record a track in an authentic Nashville studio."</p> <p>To find out more or to book a session at Nashvox, visit <u><a href="https://c212.net/c/link/?t=0&l=en&o=3156349-1&h=1402245058&u=http%3A%2F%2Fwww.nashvox.com%2F&a=www.nashvox.com&utm_source=VNN">www.nashvox.com</a></u>.</p> <p><strong><u>About Nashvox</u></strong></p> <p><u><a href="https://c212.net/c/link/?t=0&l=en&o=3156349-1&h=2667811870&u=https%3A%2F%2Fwww.facebook.com%2FNashvox%2F&a=Nashvox&utm_source=VNN">Nashvox</a></u> is an experimental recording studio in Nashville, Tennessee, that gives locals and tourists alike the space to record their favorite songs with a professional sound engineer. Visitors receive their mixed track the same day and walk away with the behind-the-scenes experience of industry experts.</p> <p><strong>Contact:</strong><br> Mandy Simone<br> 559-213-3372<br><a href="mailto:krishen@maisconsulting.com?utm_source=VNN">krishen@maisconsulting.com</a></p> <br> <strong>Related Images</strong><br> <div> <a href="https://cdn.newswire.com/files/x/6d/20/5506ff9cb5eff777919a39857ba6.jpg" target="_blank"> <img src="https://cdn.newswire.com/files/x/94/8c/7afd774ad6ab8267f8769e8d3458.jpg" alt="Luke B on the catalog" width="160" height="110"> <br> <small><b>Luke B on the catalog</b></small> </a> <br> <small>Come in just to see the place - like a museum !!!</small> <br><br> </div> <div></div> <br><br> Press Release Service by <a href="https://www.newswire.com/">Newswire.com</a> <br><br>Original Source: <a href="https://www.newswire.com/news/krishen-iyer-and-mais-consulting-come-on-board-to-the-nashvox-team-21393703"> Krishen Iyer and MAIS Consulting Come on Board to the Nashvox Team </a> <img src="https://stats.newswire.com/x/im?ref=WyIzMzZ1YTgiXQ&hit%2Csum=WyIya3UxamEiLCIya3R3M2ciLCIzMzZ1YTgiLCIzMzZ1b3oiXQ" width="1" height="1">

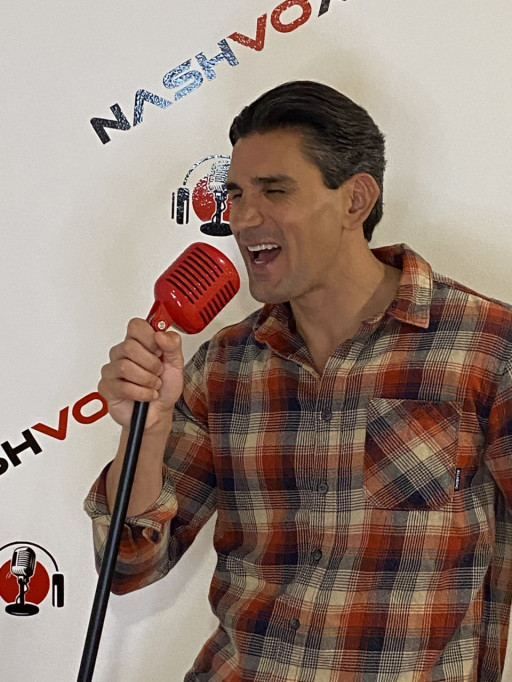

Even Bad Vocals Welcome

Have Fun

Nashvox experiential recording studio expanded its leadership team on April 2, 2021, to include Krishen Iyer as minority owner and advisor. Iyer brings years of experience as a serial entrepreneur and business consultant to Nashvox. He and the existing Nashvox team will steer the studio through COVID precautions and plans for future growth.

The Nashville establishment was founded by Teresa Smith and specifically caters to groups and parties, allowing more people to experience the thrill of recording music that has historically only been available to professionals. The recording location on 4th Avenue offers a music catalog of more than 19,000 songs from top artists like Luke Bryan and Lenny Kravitz and allows visitors to record original music. Each session is accompanied by a qualified sound engineer to guide the process.

Iyer feels confident in the studio's vision of making recording more accessible to the masses: "Whether you're part of a bridal party or a kid's birthday party, you're welcome. We want everyone of all ages to feel what it's like to record a track in an authentic Nashville studio."

To find out more or to book a session at Nashvox, visit www.nashvox.com.

About Nashvox

Nashvox is an experimental recording studio in Nashville, Tennessee, that gives locals and tourists alike the space to record their favorite songs with a professional sound engineer. Visitors receive their mixed track the same day and walk away with the behind-the-scenes experience of industry experts.

Contact:

Mandy Simone

559-213-3372

krishen@maisconsulting.com

Related Images

Luke B on the catalog

Come in just to see the place - like a museum !!!

Press Release Service by Newswire.com

Original Source: Krishen Iyer and MAIS Consulting Come on Board to the Nashvox Team

MORE NEWS

Meet Myles O’Neal, Shaquille O’Neal’s stepson: the model, DJ and reality TV star took on the ex-LA Lakers star’s surname – now the duo are making waves in the music industry as the O’Neal Boyz

The younger O’Neal is a multi-hyphenate who made his runway debut with Dolce & Gabbana before landing a Coach campaign and appearing on Basketball Wives; now he’s making music with his stepdad

Meet Whitney Leavitt: The Secret Lives of Mormon Wives ‘villain’ is a full-time influencer who’s been involved in multiple controversies, from ‘soft swinging’ to promoting Bellesa adult toys

The MomToker faced backlash in 2022 for a video of her dancing in hospital with her sick infant son; she’s now expecting her third child with husband Conner, who admitted to using Tinder while married.

Meet Noah Centineo’s mum Kellee Janel, who just got married: the spin and yoga instructor moved to LA for her son’s acting career … then he scored the lead in To All the Boys I’ve Loved Before

Last month the former teen heartthrob and The Fosters alum walked his mother down the aisle on Italy’s Amalfi Coast – but what do we know about his biggest supporter over the years?

Interest rate cut hopes raised as wage growth slows

Expectations of a rate cut next month increase as pay growth slows to its lowest rate for more than two years.

20 Travel Products From Target So Good, Even Light Packers Will Make Space For Them

We support you and your zero checked bags EVER agenda. View Entire Post ›

Disney+ K-drama Jeongnyeon: The Star Is Born – Kim Tae-ri in evocative period music drama

Kim Tae-ri stars as talented young singer Yoon Jeong-nyeon whose mother (Moon So-ri) tries to stop her singing, in this Disney+ period drama.

The Stock Market’s Bullish Run Is Likely to Continue, Analysts Say

The bullishness on Wall Street is largely based on confidence that the Federal Reserve will tame inflation, the economy will remain solid and corporate earnings will continue to grow.

Tina Brown, the Queen of Legacy Media, Takes Her Diary to Substack

She made her name leading glossy magazines. Now she’s joining the newsletter flock.

Pitchfork Alumni Launch New Music Publication, Hearing Things

After the popular publication was folded into GQ, a group of them is striking out on its own. One of the first orders of business: doing away with album scores.

PM does not rule out NI rise for employers

Sir Keir Starmer says this month's Budget was "going to be tough" but would "focus on rebuilding our country".

3 Las Vegas Experiences That Deserve Way More Attention, And 3 That Can't Get Much More Overrated

Some of these places deserve wayyyyyy more attention. Others, I definitely could have passed on. View Entire Post ›

Salzburg’s Mozart trail, from composer’s birthplace to his family home and favourite cafe

Stroll around Austria’s fourth largest city and take in the places where Mozart was born, lived, and composed and conducted music.

It's not the pizza, say dermatologists. What really causes acne breakouts

As common as acne is, experts say there are some popular misconceptions about its causes. Research suggests diet and poor hygiene are not the clear culprits, but rather a multitude of factors are at play, including genetics, hormonal changes — and stress.

This Guelph, Ont., couple is looking for a surrogate via social media after frustrating search

For Stephanie Craig and Mike Murphy, trying to grow their family has been difficult. Craig had a miscarriage in 2018 at 24 weeks and they tried IVF. Since then, the Guelph, Ont., couple have been looking for a surrogate, including now through social media.

Bridging the Action-Awareness Gap: Trip.com Group’s 2024 Sustainable Travel Consumer Report Insights

Trip.com Group, a leading global travel service provider, reveals that while sustainability awareness is rising among travellers, there remains a gap between awareness and action. This is one of the key insights from the Sustainable Travel Consumer Report 2024 that the Group released today.

Four Seasons and Lucid Team Up to Offer Guests Sustainable Driving Experiences

Global luxury hospitality leader Four Seasons and Lucid Group, Inc., maker of the world’s most advanced electric vehicles, announce a new partnership grounded in a shared vision of an exceptional, sustainable lifestyle. The collaboration underscores both companies’ commitment to environmental stewardship and responds to a growing guest desire for added flexibility and unique, eco-friendly experiences during their stay.

Unveiling the Neolithic: Türkiye Hosts Groundbreaking Global Congress

From 4th -8th November , 2024, the Southeastern Anatolian city of Şanlıurfa, home to the globally significant Neolithic sites of Göbeklitepe and Karahantepe, will host the World Neolithic Congress, the first of its kind. Organised under the auspices of the Ministry of Culture and Tourism and the Türkiye Tourism Promotion and Development Agency (TGA), this pioneering event will bring together approximately 1,000 scholars from 64 countries and 487 institutions to advance research and understanding of Neolithic cultures worldwide.

Sardinia Beyond Summer

As autumn takes hold across Europe, Chia Laguna Resort, Sardinia welcomes guests seeking warm temperatures and activity filled days. Following an outstanding season marked by double-digit growth in occupancy rates, the resort welcomes all types of traveller to three distinct properties - Conrad Chia Laguna Sardinia, Baia di Chia Resort Sardinia - Curio Collection by Hilton, and Hotel Village

Innsbruck Winter Safari - Five Unique Experiences in the Capital of the Alps

A far cry from the traditional African safari and catching sight of the ‘Big Five’ – Austria’s ‘Capital of the Alps’ offers instead five unique experiences for winter wanderers. From skiing under the stars or travelling through time at a Victorian Christmas market, to a magnificent carnival event that is only held every five years, the Innsbruck region is a hidden jewel, just waiting to be discovered.

The Gambia Experience Celebrates First Flight With a Vibrant Cultural Welcome

The Gambia Experience celebrated its first flight of the season departing from Gatwick to Banjul on Friday, (11th Oct) marking over 35 years of winter sun holidays to The Gambia. Upon arrival at Banjul International Airport, passengers were warmly welcomed by The Gambia Experience resort team and British High Commissioner to The Gambia, Harriet King before being treated to a vibrant and welcoming reception from a local dance troupe, The Jola Cultural Group. Their energetic drumbeats and colourful costumes set the tone for a memorable holiday, providing an authentic, immersive experience, and first taste of the rich cultural traditions that make the destination so special.

I'm a two-Michelin-star chef - and this is why British food is the BEST in the world. Do YOU agree?

The vote of confidence comes from Jeremy Chan, head chef at restaurant Ikoyi in London and who's created the new first-class menu for Eurostar.

Stay22 Expands Partnership With Booking.com

Stay22, the travel tech company that offers affiliate revenue generation opportunities for travel content creators, has announced the integration of Booking.com’s wide range of products. This partnership will offer Stay 22’s network of over 2,700 global content creators the opportunity to generate revenue from every element of the travel experience in one place, including accommodations, flights, car rentals, and attractions, within their platforms.

If You Refuse To Check Any Bags While Traveling, You Need These 27 Carry-On Essentials

Genius packing hacks, like a shirt that can be worn six ways, solid shampoo bars, and more. View Entire Post ›

Octopus farming is cruel and governments must stop funding it, farm reform campaigners say

Octopuses are intelligent, solitary creatures, and governments must stop funding ‘cruel and unsustainable’ octopus farms, reformers say.

Google turns to nuclear to power AI data centres

The tech giant says it will use energy from small reactors to power its use of artificial intelligence.

Want to eat like royalty? Visit a stunning Scottish mansion owned by King Charles charity

For US$490 you can eat an authentic 18th century feast served by a butler at the British monarch’s table in Dumfries House, Scotland.

Hong Kong’s Chinese Culture Festival inspires sense of heritage and national pride

Four-month event featured music, dance, Chinese opera, multi-arts programmes, films, exhibitions, lectures, artist talks and masterclasses.

South Korean rapper Lil Cherry, aka Mukkbang Mama, on working with her brother Goldbuuda and how her song ‘Crying in da Club’ was partly inspired by Lucy Liu’s character in Charlie’s Angels

The poet-turned-rapper tells Style about seeing Flo Rida perform in high school, and how All Eggs in the Basket is not just the name of her upcoming release but a mantra for life.

K-pop band CNBlue reflects on their 14-year career and new mini-album X

CNBlue hit the big time in 2010 after their song Loner became a huge hit, and 14 years on, they talk about their career and new mini album X.

Americans, Share With Us The "Culture Shock" Moments You Had While Traveling To Another State

The Southern California mind (me) cannot comprehend the concept of a Vermont autumn... View Entire Post ›

Americans suing for right to buy Hermès Birkin bags add fraud, false advertising claims

Plaintiffs in antitrust case over Hermès limiting ability to buy coveted bags to customers who purchase other items amend their complaint.

Style Edit: Margot Robbie, the latest face of Chanel N°5, stars with Jacob Elordi in a short film inspired by the spirit of Gabrielle ‘Coco’ Chanel

A Chanel ambassador since 2018, Robbie succeeds the likes of Nicole Kidman, Catherine Deneuve and Marion Cotillard as the face of the iconic fragrance.

Trump and Harris Both Like a Child Tax Credit but With Different Aims

Kamala Harris’s campaign is pushing a version of the credit intended to fight child poverty, while Donald J. Trump sees the program primarily as a tax cut for people higher up the income scale.

Tired of pumpkin spice? Here are meaningful ways to ring in the fall season in sunny L.A.

I went on a quest to find worthwhile fall rituals. Here's what I found.

Would Donald Trump’s taxes on trade hurt US consumers?

What could happen if Donald Trump drastically increases tariffs as he has promised to do?

Hong Kong Asian Film Festival 2024: 10 of the best movies to see, including The Last Dance

This year’s programme includes a drama ripped from Hong Kong headlines, a social satire in a near-future Japan and a modern romantic drama.

Why there's a rush of African satellite launches

Falling launch costs have given African nations a chance to send their own satellites into orbit.

American equal pay icon Lilly Ledbetter dies aged 86

Alabama woman's case led to law, signed by Barack Obama, that gave Americans more rights to sue for pay discrimination.

Meet former US House speaker Nancy Pelosi’s youngest daughter Alexandra: the Emmy-nominated filmmaker is a prolific documentarian and describes herself as the ‘paparazzi of the family’

The youngest Pelosi’s 2022 documentary, Pelosi in the House, includes recordings she made of the January 2021 US Capitol attack – footage that was later used during an investigation into the riots

Killing of Japanese Boy Leaves Chinese Asking: Is This My Country?

Angry at what they view as China’s state-led xenophobia, taught in schools and prevalent online, some people are taking action, even at personal risk.